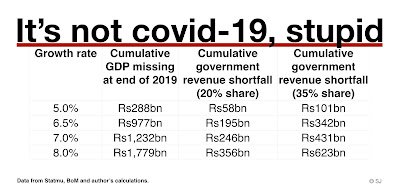

We should make sure all 50-odd African countries are in attendance along with two university buddies. Then bring up the above table on the screen while a fresh round of gato-pima is served. And explain that by the end of last year Mauritius had about Rs1,800 billion of GDP missing compared to what the 8% growth the flat tax was supposed to generate – that’s 36 times how much GDP is roughly expected to fall this year from where it was at the end of 2019. If we assume a very conservative 20% cut for government revenue and the monies are left in a drawer (they are not reinvested) then there is more than Rs350bn of government revenue missing. This could have been placed in a sovereign wealth fund (SWF) that would have easily got us over the bump in the road that the pandemic is now creating.

But we should have increased the share of government revenue to the OECD average of 35% as our population has been aging since 2005, to improve our welfare state and to bring back retirement age to 55 years so we mitigate our serious brain-drain problem. This would have boosted the SWF to Rs623bn. Even if we had grown at 6.5% over the past fourteen years there would have been between 195bn to 342bn rupees available to prepare us for any tough situation. Why is 5% in the table? It’s our average growth for the fourteen years – a period of progressive and sustainable taxation – before Sithanen started screwing up the economy and Mauritius big time. So even in this worst case scenario there would have been Rs58bn-Rs101bn of extra government revenue available for a bad year like 2020. Without compromising the independence of the BoM, destroying our savings culture and sending our rupee into a tailspin.

Minister Padayachy has increased personal top tax rates to 40%. He had little choice. We don’t want to have a massive social crisis.

No comments:

Post a Comment