Saturday, May 30, 2020

Sunday, May 24, 2020

Mauritius Should Showcase the Sithanen Flat Tax Hell

We should make sure all 50-odd African countries are in attendance along with two university buddies. Then bring up the above table on the screen while a fresh round of gato-pima is served. And explain that by the end of last year Mauritius had about Rs1,800 billion of GDP missing compared to what the 8% growth the flat tax was supposed to generate – that’s 36 times how much GDP is roughly expected to fall this year from where it was at the end of 2019. If we assume a very conservative 20% cut for government revenue and the monies are left in a drawer (they are not reinvested) then there is more than Rs350bn of government revenue missing. This could have been placed in a sovereign wealth fund (SWF) that would have easily got us over the bump in the road that the pandemic is now creating.

But we should have increased the share of government revenue to the OECD average of 35% as our population has been aging since 2005, to improve our welfare state and to bring back retirement age to 55 years so we mitigate our serious brain-drain problem. This would have boosted the SWF to Rs623bn. Even if we had grown at 6.5% over the past fourteen years there would have been between 195bn to 342bn rupees available to prepare us for any tough situation. Why is 5% in the table? It’s our average growth for the fourteen years – a period of progressive and sustainable taxation – before Sithanen started screwing up the economy and Mauritius big time. So even in this worst case scenario there would have been Rs58bn-Rs101bn of extra government revenue available for a bad year like 2020. Without compromising the independence of the BoM, destroying our savings culture and sending our rupee into a tailspin.

Minister Padayachy has increased personal top tax rates to 40%. He had little choice. We don’t want to have a massive social crisis.

Savings Likely to Hit At Least 60-year Low

It was there already in 2018 when it matched the 9% it reached after intense cyclone Danielle inflicted a 17.6% contraction to the Mauritian economy. As the table shows savings increased by a tiny bit last year but not enough to avoid the top three worst spots before COVID-19 arrived on the scene. We must also note that SSR is the only Prime Minister to have his two entries in the table linked to two intense cyclones. The other three PMs appear there because of two things. The first is the Sithanen flat tax which has broken the economy. The other is the removal of the tax exemptions which the people of Mauritius had been using to set up their long-term financial plans.

The situation for Pravind Jugnauth is pretty worrying as all his three years as PM are very bad years for this fundamental statistic of economic resilience. Given that the figure for this year will likely go at the top of the table he should bring back some basic common sense by restoring a sustainable and progressive tax structure and personal deductions. This should start compensating for his extremely poor economic management of the past five years.

Tuesday, May 19, 2020

African Countries With the Worst Covid-19 Death Intensity

As shown in the above table Mayotte is the African territory with the highest number of covid-19 deaths per capita and that too by a large margin. Its figure for cases per million people was even higher than that for Spain on May 13. This is pretty bad given that it had only 6 cases on March 20. A weak health system is part of the reason. Not unlike in France where thousands of beds have been eliminated in hospitals during the last two decades.

Mauritius is at number four. We wasted precious time in the beginning when politicians were blurting out a lot of dangerous rubbish. We’ve seen how fundamental a good universal public health system is. We need to seriously upgrade ours. This involves a course correction.

Mauritius is at number four. We wasted precious time in the beginning when politicians were blurting out a lot of dangerous rubbish. We’ve seen how fundamental a good universal public health system is. We need to seriously upgrade ours. This involves a course correction.

Sunday, May 17, 2020

Why Our Government Hasn’t Been Functioning Properly

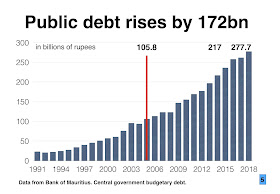

Three words. Sithanen flat tax. As it never produced the higher growth rates (8%) our central government has been piling up so much debt – increasing from a total of Rs106bn to Rs278bn between 2005 and 2018 – that it had to resort to creative accounting, push up the debt ceiling several times and has failed to solve many national problems. The USD has also appreciated by one-third against our rupee over the past 15 years. Not a good sign. Definitely not what you’d expect from a Tiger. But pandemics have such a way of bringing back sanity.

Friday, May 15, 2020

Covid-19 Crisis Not Unprecedented

Nope. As the chart shows our GDP contracted by 10% in 1980 after cyclone Claudette visited us in the dying days of 1979. The contraction estimated by the Ministry of Finance for this year is between 7% and 11% so it’s going to be roughly the same. What’s going to be different is that since 2005 government has been working for the 1% while 41 years ago important components were being added to our welfare state helping tens of thousands of us have more meaningful lives.

Thursday, May 14, 2020

Wednesday, May 13, 2020

Na Pa Tus Konze Travayer

Guvernman pe anvi kup konze travayer a koz covid-19. Fode pa li fer sa parski konfinman se pa en konze me en leksperians difisil kot dimun fin bizin res lakaz pu res an vi. Ena buku zafer li kav fer a la plas:

1. En konpayni pa gayn drwa diman kudme ek guvernman si li pan kup so dividen ek kup depans fla fla. Bizin usi kone komye fwa la pey ek benefis so CEO pli for ki travayer ek pli ti lapey. Ban aksyoner kav reinvesti dan zot konpayni pu kumanse.

2. En konpayni pa gayn drwa met dimun deor brit si li ena rezerv uswa fin fer profi u fin pey ban dividen egzazere ban dernye lane. Li bizin pa gayn drwa met travayer deor apre rod travayer pli bon marse depi lot pei.

3. Guvernman bizin introdwir en wealth tax ek remet taksasyon progresif.

4. Si bizin kup lapey u lavantaz ban travayer bizin fer li de fason progresif. Dimun ki gayn ziska 30,000 par mwa pa gayn kupe e dimun ki gayn 500,000 par mwa u plis kup ant 50% ek 75%.

5. Kansel tu privilez duti-fri pu loto pu prosen sink an.

6. Obliz tablisman plant manze lor zot later ek friz tu proze IRS/RES/PDS.

7. Friz dezyem faz tram ekspres ek pran kas ka don CEB pu li investi masivman dan soler/eolyen pu ki pri kuran vin byin pre a zero.

8. Remet laz retret 60 an kumsa kav angaz plis zen.

1. En konpayni pa gayn drwa diman kudme ek guvernman si li pan kup so dividen ek kup depans fla fla. Bizin usi kone komye fwa la pey ek benefis so CEO pli for ki travayer ek pli ti lapey. Ban aksyoner kav reinvesti dan zot konpayni pu kumanse.

2. En konpayni pa gayn drwa met dimun deor brit si li ena rezerv uswa fin fer profi u fin pey ban dividen egzazere ban dernye lane. Li bizin pa gayn drwa met travayer deor apre rod travayer pli bon marse depi lot pei.

3. Guvernman bizin introdwir en wealth tax ek remet taksasyon progresif.

4. Si bizin kup lapey u lavantaz ban travayer bizin fer li de fason progresif. Dimun ki gayn ziska 30,000 par mwa pa gayn kupe e dimun ki gayn 500,000 par mwa u plis kup ant 50% ek 75%.

5. Kansel tu privilez duti-fri pu loto pu prosen sink an.

6. Obliz tablisman plant manze lor zot later ek friz tu proze IRS/RES/PDS.

7. Friz dezyem faz tram ekspres ek pran kas ka don CEB pu li investi masivman dan soler/eolyen pu ki pri kuran vin byin pre a zero.

8. Remet laz retret 60 an kumsa kav angaz plis zen.